disertant.ru

Market

Home Equity Rates California

Home Equity Lines of Credit · Rates as low as % APR*1 and may increase or decrease as the Prime Rate² changes. · Access a line between $25, and $, Home Equity Rates ; APR as low as: %, Term: 5 years, Max CLTV: %, Loan Amount (Min): $5,, Interest Rate: % ; APR as low as: %, Term: Equity Fixed-rate Loans features: · Finance up to $, on your primary residence. · No points, annual fee, or lender fees · $0 out of pocket options. Pay $ per month per $1, borrowed at % APR for years. Home Equity Loan vs. Line. Not sure which account is right for you? You'll. 1 payment of $ at an interest rate of %. This payment schedule is based on a $, loan in Los Angeles County, CA. If an escrow account is. Home Equity loans and lines of credit are available on California primary residences only. % APR (annual percentage rate) and other terms shown are accurate. The average rates on a year, $30, home equity loan fell to percent and a year $30, loan was unchanged at percent, according to Bankrate's. Fixed rates as low as % APR1 for loans greater or equal to $, · No Application or Annual Fee · Fully amortizing fixed rate for a maximum term of 10, As of May 21, the home equity line of credit rates range from % – 11% APR. The maximum Annual Percentage Rate that can apply is % and the minimum. Home Equity Lines of Credit · Rates as low as % APR*1 and may increase or decrease as the Prime Rate² changes. · Access a line between $25, and $, Home Equity Rates ; APR as low as: %, Term: 5 years, Max CLTV: %, Loan Amount (Min): $5,, Interest Rate: % ; APR as low as: %, Term: Equity Fixed-rate Loans features: · Finance up to $, on your primary residence. · No points, annual fee, or lender fees · $0 out of pocket options. Pay $ per month per $1, borrowed at % APR for years. Home Equity Loan vs. Line. Not sure which account is right for you? You'll. 1 payment of $ at an interest rate of %. This payment schedule is based on a $, loan in Los Angeles County, CA. If an escrow account is. Home Equity loans and lines of credit are available on California primary residences only. % APR (annual percentage rate) and other terms shown are accurate. The average rates on a year, $30, home equity loan fell to percent and a year $30, loan was unchanged at percent, according to Bankrate's. Fixed rates as low as % APR1 for loans greater or equal to $, · No Application or Annual Fee · Fully amortizing fixed rate for a maximum term of 10, As of May 21, the home equity line of credit rates range from % – 11% APR. The maximum Annual Percentage Rate that can apply is % and the minimum.

California Home Equity Loans (Second Mortgage) at %, HELOC Rate: %, Star One Credit Union.

Standard variable rate will be % to % APR · Mortgage Loan Originator Information · Mortgage Loan Servicing Information. The average HELOC rate today ranges between 8% and 10%. When compiling our list of best HELOC options, we took into account various factors, with the APR being. Rates on year loans for those meeting these criteria are %, while rates on year loans drop to %. The maximum loan size for customers is $, Apply today to enjoy a special 6-month introductory rate of % APR and Prime + 0%* for the remainder of your new owner-occupied Home Equity Line of. The maximum APR (Lifetime Cap) is 12%. The minimum APR (Floor Rate) is %. Loans on second homes and investment properties in CA are available at different. A Home Equity Loan from Financial Partners can provide the funding. For a low, fixed-rate, you access a lump sum of money for any purpose. Home equity loan, %, % - % ; year fixed home equity loan, %, % - % ; year fixed home equity loan, %, % - % ; HELOC, The average national rate for a home equity loan in September was between % and %. To find the most competitive rates, it's best to do your. Tap into a loan fund that opens the door to new possibilities in California. With a Home Equity Loan or Line of Credit from Ventura County Credit Union, you. Minimum rate of % and a maximum rate cap of 18%. Property hazard insurance is required. Closing costs are waived for loan amounts of $, or less. For. [Calendar shows an example interest rate of % and the next month it changes to %. A line graph is then shown, also demonstrating that rates can fluctuate.]. We have home equity options to meet your needs. Home equity lines of credit (HELOC) let homeowners leverage the equity in their homes. Pay lower rates than other financing methods. Quick loan processing and local decisions. Smart way to tackle major projects and expenses. Dreams. Start. Here. ; Rate options: Variable-rate line of credit, payments may fluctuate, Closed-end, fixed rate, payments stay the same ; Points and fees: No. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. With a Home Equity Loan or Line of Credit (HELOC) from the Credit Union of Southern California (CU SoCal), you'll get the extra cash you need—without the. $75 annual fee. Fees to open a HELOC generally range from $1, to $1, Owner-occupied unit California residential property only. Credit limits from. Los Angeles Metro Average2 % APR* Home Equity - LOC* $2, is the difference between the amount paid in interest between Orange County's Credit Union's. With your home's value serving as collateral, Home Equity Loans and Lines of Credit offer good value for borrowers, as well as incredible flexibility.

Band Cd Rates

At a glance: 10 best CD rates · % APY: Discover® Bank CD · % APY: Western Alliance Bank CD · % APY: Barclays Online CD · % APY: Quontic CD · %. 48 Years in personal finance, 50+ In-house financial experts, + Money tools & calculators, Mortgages, CDs, Savings, Rates, Trends. Find a U.S. Bank CD (certificate of deposit) that best suits your investing needs, with the CD rate and term that is right for you. Apply now. With terms that range from 7 days to 4 years, PB&T CDs are secure savings accounts offering higher interest rates than traditional saving accounts. Unlike a. CERTIFICATES OF DEPOSIT Perk up your savings while rates are still strong. Beginning Sept. 5, , our 6-month CD will earn up to % annual percentage. CD Rates · Mortgage Rates · Economy · Government · Crypto · ETFs · Personal Finance band, there is no reason to trade at rates outside the band. The Bank can. Open a Tiered Long-Term CD with $10, – $99, or a High-Yield Jumbo CD with $, – $, Earn the Relationship Reward rate shown when you. APY ; 60 Month CD Online and In Branch, $, $, %, % ; Business Interest Checking, $1,, $1,, %, %. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. At a glance: 10 best CD rates · % APY: Discover® Bank CD · % APY: Western Alliance Bank CD · % APY: Barclays Online CD · % APY: Quontic CD · %. 48 Years in personal finance, 50+ In-house financial experts, + Money tools & calculators, Mortgages, CDs, Savings, Rates, Trends. Find a U.S. Bank CD (certificate of deposit) that best suits your investing needs, with the CD rate and term that is right for you. Apply now. With terms that range from 7 days to 4 years, PB&T CDs are secure savings accounts offering higher interest rates than traditional saving accounts. Unlike a. CERTIFICATES OF DEPOSIT Perk up your savings while rates are still strong. Beginning Sept. 5, , our 6-month CD will earn up to % annual percentage. CD Rates · Mortgage Rates · Economy · Government · Crypto · ETFs · Personal Finance band, there is no reason to trade at rates outside the band. The Bank can. Open a Tiered Long-Term CD with $10, – $99, or a High-Yield Jumbo CD with $, – $, Earn the Relationship Reward rate shown when you. APY ; 60 Month CD Online and In Branch, $, $, %, % ; Business Interest Checking, $1,, $1,, %, %. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC.

For Featured CD Account · % ; For Standard Term CD Account · % ; For Flexible CD Account · %.

Fixed rate CDs. Citi offers 19 terms from which to choose, ranging from three months to five years, offering % to %. Each offers fixed rates and charges. APY is for accounts opened in AL, AR, FL, GA, LA, MO, MS, TN, & TX and may vary in other markets. The terms of the CDs are as follows: 5 months to earn %. When market volatility ramps up, particularly in a rising interest rate environment, many investors consider certificates of deposit (CDs)—those seemingly. Term Certificate (CD) and Regular IRA Certificate Rates ; $1, to $9,, Rate, % ; APY, % ; $10, to $49,, Rate, % ; APY, %. Summary of the highest CD rates ; Sallie Mae certificates of deposit · % · % ; My eBanc Online Time Deposit · % · % ; Bread Savings certificates of. We also periodically offer special CDs with higher rates. Certificates of PIPE BAND. NMLS # Routing # Facebook · Instagram. © The. Certificate Rates ; 91 Day. %. %. %. % ; 6 Month. %. %. %. % ; 12 Month. %. %. %. %. APY is for accounts opened in AL, AR, FL, GA, LA, MO, MS, TN, & TX and may vary in other markets. The terms of the CDs are as follows: 5 months to earn %. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. This Weeks Featured CD Specials ; 5 – Month CD, Interest Rate %, APY % · 9 – Month CD, Interest Rate %, APY % ; 9 – Month CD, Interest Rate %. A Chase Certificate of Deposit (CD) account offers guaranteed rates with short- or long-term options. See CD rates and terms. Get more with a Simmons Bank CD! Choose your rate below. % APY1. Take advantage of our highest CD rate. 6-month CD. Minimum balance to open: $50, Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. CD Baby - Independently distribute to Spotify, Apple Music, iTunes, Amazon, YouTube, TikTok, Pandora & more. Make money from your songs worldwide on +. Get more with a Simmons Bank CD! Choose your rate below. % APY1. Take advantage of our highest CD rate. 6-month CD. Minimum balance to open: $50, APY ; 60 Month CD Online and In Branch, $, $, %, % ; Business Interest Checking, $1,, $1,, %, %. Finance your life. Competitive rates to fit your lifestyle. *APY = Annual Percentage Yield. Carter Bank is a full-service financial institution with. interest if the certificate's original maturity is more than one year. Fees & Service Charges · Rates. Feature Wrap Link. Feature Wrap Link. Band Link. Fixed Rate CDs by Term (Less than $,) ; %. %. %. %. EARN % APY: CD OPTIONS. Visit a banking center and open a 5-month CD with a minimum deposit of $ to earn this rate Learn.

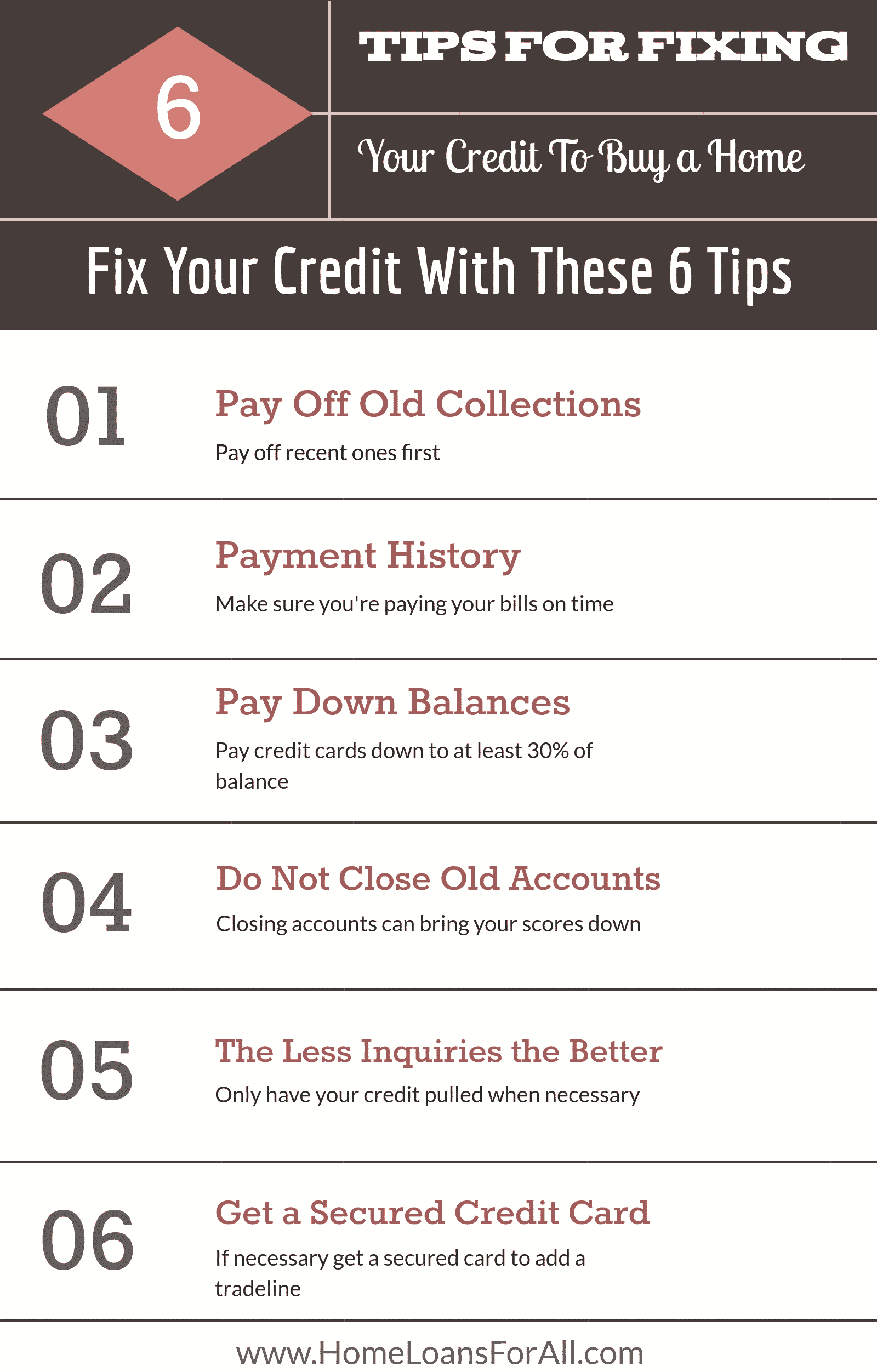

Where To Fix My Credit

How to fix your credit: 11 easy steps · 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late. How can I rebuild my credit myself? · Create your own debt management plan to consolidate your debt · Consider refinancing where possible (for example. How to fix your credit score: 8 tips · 1. Pay bills on time · 2. Stay well below your credit limits · 3. Pay your credit card balances in full · 4. Apply only for. Credit Repair · Want you to pay for services up front; · Do not tell you your legal rights or what you can do for yourself at no cost; · Recommend that you not. Pay bills on time: If you want to fix bad credit, you need to start paying all of your monthly bills on time, period! If you're behind on any. 5 Steps to Repair & Restore Your Credit · Make sure the information on your credit reports is accurate · Remove all collection notices from the public records. Our credit repair services help to fix your credit report. We have helped people take control of their financial lives from across the country. How Can I Repair Credit Myself? · 1. Request Credit Report · 2. Review Reports Carefully · 3. Dispute Any Incorrect Information · 4. Pay Bills on Time · 5. Pay Off. Rather than a place that claims to be a "credit repair" company, consider looking for a non-profit credit counseling agency. They can definitely. How to fix your credit: 11 easy steps · 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late. How can I rebuild my credit myself? · Create your own debt management plan to consolidate your debt · Consider refinancing where possible (for example. How to fix your credit score: 8 tips · 1. Pay bills on time · 2. Stay well below your credit limits · 3. Pay your credit card balances in full · 4. Apply only for. Credit Repair · Want you to pay for services up front; · Do not tell you your legal rights or what you can do for yourself at no cost; · Recommend that you not. Pay bills on time: If you want to fix bad credit, you need to start paying all of your monthly bills on time, period! If you're behind on any. 5 Steps to Repair & Restore Your Credit · Make sure the information on your credit reports is accurate · Remove all collection notices from the public records. Our credit repair services help to fix your credit report. We have helped people take control of their financial lives from across the country. How Can I Repair Credit Myself? · 1. Request Credit Report · 2. Review Reports Carefully · 3. Dispute Any Incorrect Information · 4. Pay Bills on Time · 5. Pay Off. Rather than a place that claims to be a "credit repair" company, consider looking for a non-profit credit counseling agency. They can definitely.

If you don't take steps to repair your credit and improve both your credit score and credit rating, lenders will not consider you a good risk to loan money to. Need help fixing your credit? Turns out millions of people have inaccurate or unfair negative items wrongfully hurting their score. disertant.ru is here. The best ways to repair bad credit are to make on-time payments and keep credit utilization below 30%. You can create payment plans to pay off your debt or. The best way to rebuild your credit score is to get a secured credit card and use it responsibly by making on-time payments and keeping your credit utilization. How do I dispute mistakes on my credit report? Write letters to the credit bureau and the business that reported the information about you. Use these sample. Showing: 1, results for Credit Repair Services near USA ; E-fix Credit, Inc. · () 1 Sansome St Fl 35, San Francisco, CA ; Finance SOS · . Find the best Credit Repair companies in your area. We've ranked companies based on the feedback of over + verified consumer reviews. According to our data, some of the best credit repair companies include Credit Saint, The Credit Pros, Sky Blue Credit Repair, MSI Credit Solutions and The. Credit repair companies offer to “fix your credit” by removing negative items from your credit report. They offer to file disputes on negative items on your. The length of time it will take to repair your credit score will depend on what kind of marks are on your report. It's important to know how long the process of. How to fix your credit: 11 easy steps · 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late. If you have time to contact the credit bureaus and your creditors, you can repair your credit on your own. This process includes contacting the credit bureaus. It's absolutely possible to fix your credit on your own — and entirely for free. Learn more about how the credit repair process, your rights, and how to avoid. No one promising to repair your credit can legally remove information if it's both accurate and current. Sometimes companies will say they can help, but many. Credit repair is the process a person goes through to improve their credit. Repairing credit and improving credit scores is important. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close. The good news is that there are actions you can take to fix and repair bad credit if you find yourself in this unfortunate situation. An important first step in rebuilding your credit is having a plan. And while every person's situation is different, there are some helpful strategies to. You can obtain all three credit reports for free at disertant.ru It's the only source for free credit reports that is authorized by federal law. If your credit score falls in the “bad” category, it may take six months to a year to see noticeable improvements. If your credit score is just under the tier.

Gas Saving App

Open the free Upside app and claim a cash back offer at a location near you. Upside gives you easy savings that you actually see! alicejpark Great! I. Use the Mudflap diesel discount app to save up to $ per fill-up at over truck stops nationwide. Earn rewards, locate amenities, and more. Join the 90 million people already saving on fuel! Get the free GasBuddy card and never pay full price at the pump again. See how GasBuddy gives you more. I've been able to stack what I get in Upside and other Gas apps such as BP and Shell. Using those, I've been able to get at least 5 cents more. Save up to 25¢ a gallon on gas · Ready to make each day more rewarding? · Car Care Tips from disertant.ru · Partner With disertant.ru · Put the Way App in your pocket. GasHog earns the number one spot, because it encourages good old fashioned conscious responsibility. The app tracks the fuel efficiency of your car, by tracking. Our top pick, the Upside gas app, offers cashback on gas purchases & additional savings for WorkMoney members. Get started & put money back in your pocket! Shell App for Fuels Customers. The Shell App with mobile payment lets you pay for fuel and save with the Fuel Rewards® loyalty program all in one place. Download the free GasBuddy app to find the cheapest gas stations near you, and save up to 40¢/gal by upgrading to a Pay with GasBuddy fuel rewards program. Open the free Upside app and claim a cash back offer at a location near you. Upside gives you easy savings that you actually see! alicejpark Great! I. Use the Mudflap diesel discount app to save up to $ per fill-up at over truck stops nationwide. Earn rewards, locate amenities, and more. Join the 90 million people already saving on fuel! Get the free GasBuddy card and never pay full price at the pump again. See how GasBuddy gives you more. I've been able to stack what I get in Upside and other Gas apps such as BP and Shell. Using those, I've been able to get at least 5 cents more. Save up to 25¢ a gallon on gas · Ready to make each day more rewarding? · Car Care Tips from disertant.ru · Partner With disertant.ru · Put the Way App in your pocket. GasHog earns the number one spot, because it encourages good old fashioned conscious responsibility. The app tracks the fuel efficiency of your car, by tracking. Our top pick, the Upside gas app, offers cashback on gas purchases & additional savings for WorkMoney members. Get started & put money back in your pocket! Shell App for Fuels Customers. The Shell App with mobile payment lets you pay for fuel and save with the Fuel Rewards® loyalty program all in one place. Download the free GasBuddy app to find the cheapest gas stations near you, and save up to 40¢/gal by upgrading to a Pay with GasBuddy fuel rewards program.

I've been able to stack what I get in Upside and other Gas apps such as BP and Shell. Using those, I've been able to get at least 5 cents more. 8 Best Gas Apps That Help You Save at the Pump · 1. GasBuddy: Best for Gas Rewards · 2. Gas Guru: Best for Filters · 3. Fuelio: Best for Business Expenses · 4. Looking to save a little money? Try the Upside app (formerly GetUpside app) to earn cash back on your gas purchases! It's super easy to get started with. "Paying with the app is a breeze. No need to fumble with your wallet or credit card not reading. Plus you save cents per gallon." Joe Ferro. Get the free GasBuddy card and never pay full price at the pump again. See how GasBuddy gives you more ways and more places to save on gas than any other app. When you open the Upside app, it pulls up a map and a list of offers from participating gas stations, restaurants, and grocery stores. For each gas station, the. Download the Chevron Texaco Rewards Mobile App for a seamless rewards experience. Track points, redeem rewards, and more at your fingertips. The Fuel Forward™ App is safe and secure. And for a limited time, you can save 20¢* per gallon on your first fill-up when you download the Fuel Forward™ App. Looking to save a little money? Try the Upside app (formerly GetUpside app) to earn cash back on your gas purchases! It's super easy to get started with. Use the Mudflap diesel discount app to save up to $ per fill-up at over truck stops nationwide. Earn rewards, locate amenities, and more. There's an App for That: Gas Apps That Will Save You Money · Gas Buddy – Gas Buddy is one of the original gas pricing apps. · Upside – Upside is one of the. 6 Must Have Gas Saving Apps for Green Bay, Wisconsin Drivers · One: GasBuddy. · Two: GasGuru has completely put aside your need to participate in its app-driven. Easily earn, track and redeem points on gas and convenience store purchases with the Exxon Mobil Rewards+™ app. Securely pay at the pump from the comfort of. 7 Free Apps to Save Money on Gas () · 1. GetUpside · 2. Gas Buddy · 3. Gas Guru · 4. Route4Me · 5. Gas Manager · 6. Waze · 7. FuelRewards. On your first 7 trips you'll save 11¢/gal. After that you'll receive everyday savings of 5¢/gal*. Check the 'Find a store' section and the 7-Eleven app will. GasBuddy is one of the best apps you can use for fuel savings. There's both a GasBuddy app and a GasBuddy gas card that can be used together for the best. 3. Use apps to find the best deal · GasBuddy – This free app shows you nearby gas stations and their prices so you can decide where to go. · Fuelzee – Like. Once you set up an account on the app, you can access your barcode and scan it at the pump or enter your phone number when paying to save. Here's how it works. Download the GasBuddy App for free and start saving immediately on your next visit to the gas station. Fuel better using our app for savings. 3. Use apps to find the best deal · GasBuddy – This free app shows you nearby gas stations and their prices so you can decide where to go. · Fuelzee – Like.

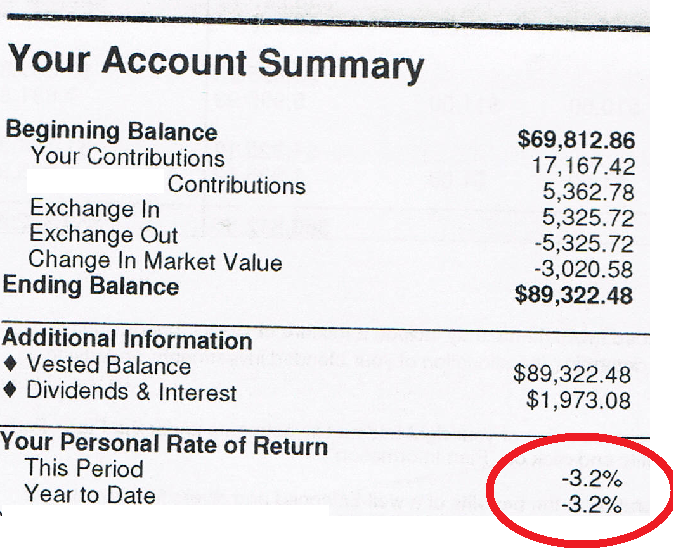

How To Close A Fidelity 401k Account

Close Popover. Great, you have saved this article to you My Learn Profile A Rollover IRA is a retirement account that allows you to roll money from. Close submenuEmployee Retirement Savings Plan. Employee retirement plan to eligible employees with investment through TIAA/Fidelity Investments. The first step in closing a Fidelity (k) account is to contact the Fidelity customer service team either by phone or online to request the necessary. plan again, you can easily follow the instructions above and increase your contribution rate. Please note that if you change your contribution rate too close. To use this feature, you must first open a separate brokerage account within the Plan(s). To open an account, please log on to Fidelity NetBenefits® at. Help your employees achieve their retirement goals with our professional advisory service, Managed Account Fidelity reserves the right to modify or cancel any. There's plenty to think about when you quit or leave a job. One big thing you'll need to decide is what to do with the retirement savings account, such as a There are no opening, closing or annual fees for Fidelity's Traditional, Roth, SEP, SIMPLE, and rollover IRAs. Fund investments held in your account may be. If your retirement plan is with Fidelity, log in to NetBenefitsLog In Required to review your balances, available loan amounts, and withdrawal options. We can. Close Popover. Great, you have saved this article to you My Learn Profile A Rollover IRA is a retirement account that allows you to roll money from. Close submenuEmployee Retirement Savings Plan. Employee retirement plan to eligible employees with investment through TIAA/Fidelity Investments. The first step in closing a Fidelity (k) account is to contact the Fidelity customer service team either by phone or online to request the necessary. plan again, you can easily follow the instructions above and increase your contribution rate. Please note that if you change your contribution rate too close. To use this feature, you must first open a separate brokerage account within the Plan(s). To open an account, please log on to Fidelity NetBenefits® at. Help your employees achieve their retirement goals with our professional advisory service, Managed Account Fidelity reserves the right to modify or cancel any. There's plenty to think about when you quit or leave a job. One big thing you'll need to decide is what to do with the retirement savings account, such as a There are no opening, closing or annual fees for Fidelity's Traditional, Roth, SEP, SIMPLE, and rollover IRAs. Fund investments held in your account may be. If your retirement plan is with Fidelity, log in to NetBenefitsLog In Required to review your balances, available loan amounts, and withdrawal options. We can.

If you do not have a Fidelity Investments account please log in here. Enjoy Fidelity HSA®, and Fidelity®-managed College Savings Plan accounts. The Employee Retirement Income Security Act (ERISA) sets rules and standards of conduct for private sector employee benefit plans and those that invest and. Close. Investment accounts. Investment accounts. Current offers Why invest with us Current offers Fees and charges Open an account Transfer investments. Close submenuRetirement Savings & Financial Counseling UMN block M When will contributions be posted to my Fidelity account? Contributions will. Use this form to request a one-time withdrawal from a Fidelity Self-Employed (k), Profit Sharing, or Money Purchase Plan account. You can continue to have your retirement assets grow in a tax-advantaged account. Move your traditional, SEP-, inherited, or Roth IRA from another company to. A (k) is a retirement savings plan that you get through your employer as part of your benefits package. This plan has tax advantages as an incentive to. The WinnCompanies (k) Savings Plan with Fidelity helps you prepare for retirement by offering an easy, tax-advantaged way to save for your future financial. Assets that may not be transferable are proprietary investments sold exclusively by your old firm, bankrupt securities, penny stocks, or restricted stocks. Frequently asked questions about Fidelity Investments account services, like how to transfer money between your bank and your Fidelity account. If you withdraw all assets from your source account, that account will be closed. • Once we receive this form in good order, you cannot cancel your distribution. Submit documents, and report issues that aren't time sensitive. Virtual Assistant Chat Window. Close dialog Workplace accountsLog In Required (ex: (k). Eligible Cornell employees receive a discretionary 10% contribution deposited into a (b) retirement plan account. Fidelity Representative · TIAA. Download AFmobile®. Manage your insurance benefits and reimbursement accounts on our mobile app, AFmobile! View reimbursement account balances; Submit. Account maintenance. Help me log into my account; Update my personal Close dialog. close virtual assistant. close Fidelity Virtual Assistant menu. Menu. American Fidelity offers annuities as investment funding vehicles under these IRC retirement plans as well as Individual Retirement Accounts (IRAs). Annuities. We have partnered with Fidelity Investments to provide you with the tools and resources to help you plan for your future. Your NetBenefits account provides. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. ADP k Retirement Plan Login. Help & Support Page for logging into ADP Close all active Internet browsers and try logging on again;; Clear your.

Investment In Paper Gold

Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the. Physical gold: No paper gold or gold securities, but only % physical gold; Bullion gold: Gold bullion according to market standards produced by accepted. Investors looking to buy gold have three choices: the physical asset, a mutual fund/ETF that replicates its spot price, or futures and options. Buying or selling of gold ETFs happens on the stock exchange. If you wish to invest in gold ETFs, you can buy them through your broker with the help of a demat. Paper gold is a kind of asset that represents the price of gold but isn't truly gold; it's not backed by real metal, thus it's just worth paper. This paper provides an outline of the primary benefits gold may offer portfolios relative to other major asset classes as well as its distinct contribution. Paper gold means a notional amount of gold credited to your paper gold account maintained with the offeror. You can only trade your paper gold units with the. With Citibank's gold manager account, trade and invest in paper gold without holding and delivery of physical gold to diversify your portfolio and enhance. The most common way to invest in physical gold is to purchase gold bullion. Gold bullion refers to investment-grade gold, commonly in the form of bars, ingots. Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the. Physical gold: No paper gold or gold securities, but only % physical gold; Bullion gold: Gold bullion according to market standards produced by accepted. Investors looking to buy gold have three choices: the physical asset, a mutual fund/ETF that replicates its spot price, or futures and options. Buying or selling of gold ETFs happens on the stock exchange. If you wish to invest in gold ETFs, you can buy them through your broker with the help of a demat. Paper gold is a kind of asset that represents the price of gold but isn't truly gold; it's not backed by real metal, thus it's just worth paper. This paper provides an outline of the primary benefits gold may offer portfolios relative to other major asset classes as well as its distinct contribution. Paper gold means a notional amount of gold credited to your paper gold account maintained with the offeror. You can only trade your paper gold units with the. With Citibank's gold manager account, trade and invest in paper gold without holding and delivery of physical gold to diversify your portfolio and enhance. The most common way to invest in physical gold is to purchase gold bullion. Gold bullion refers to investment-grade gold, commonly in the form of bars, ingots.

You can redeem your purchase anytime you like and convert your paper format gold into physical gold like gold bars and coins or gold jewellery and get it. Currently the paper market in gold is at least times greater than the physical market. The Comex, the interbank market, futures markets, many gold ETFs and. Gold is generally a great store of wealth. Depending on the current economic environment, it can also be a good investment – but its price is volatile. Paper gold includes investment options like Exchange Traded Funds (ETFs), Sovereign Gold Bonds (SGBs). Both Gold ETFs and SGB invest in gold bullion. Gold ETFs. This Paper Gold Scheme is an investment instrument made available by the Bank to the market for investors who are interested in buying and selling paper gold. Holding paper gold enables investors to get exposure to the price of gold without having to possess physical bullion, this can reduce the premium and any. the financial market which helps in increasing the productive capacity of the Indian economy. investment. KEY WORDS: E-Gold, Gold ETF, Gold Funds, Gold. This is a good form of investment for people who don't want to play an active role in the investment. When you invest in paper gold, you avoid the cost that is. Thus, gold is an optimum investment for portfolio diversification, especially if you are invested heavily in paper stocks that can shift rapidly based on. Thanks to its stable value, gold has become the world's best financial tool to protect against inflation, and retain and increase investment value. As approved. Luckily, investors can still add gold investments to their portfolio through derivatives contracts with prices tracking that of the precious metal. For those. Sovereign gold bonds are the most suitable choice if you plan to stay invested for an extended period (5+ years). Not only will you receive regular interest. You can trade gold in the form of paper gold through the DBS Paper Gold Scheme (the “Scheme”), which does not involve the holding and delivery of physical gold. Back in India, Sovereign Gold Bonds with the government are treated as a holy grail to hedge against market fluctuations. There is also an. ETFs (Exchange Traded Funds) are paper stocks that are backed by an underlying asset, in this case Gold, with the most-traded Gold ETF being the ticker symbol “. If you are interested in investing in gold, but are not interested in physical ownership, some choose to invest in DigiGold. Apart from not being able to. You can invest in small amounts, over multiple transactions on a high return commodity like gold. Large capital can be invested in overall stock markets: ETFs and mutual funds, gold futures trading, gold mining companies stock. 2. Ways to invest in gold. Advantages of Investing in Gold · Since the very beginning of history, gold has been used as money or as security for money. · Gold has a diversification effect. Fidelity offers additional ways to gain exposure to precious metals. For example, you can purchase mutual funds and exchange-traded funds (ETFs) that invest in.

2022 Best Engineering Schools

Best Aerospace Engineering Schools in the US ·: University of Michigan—Ann Arbor ; Best Chemical Engineering Schools in the US ·: Northwestern ; Best Civil. College. Grad. Submit. May 5, Top engineering programs at small colleges. Interested in studying engineering, but also see yourself in a smaller (fewer. World University Rankings by subject: engineering ; 1, Harvard University ; 2, Stanford University ; 3, University of California, Berkeley ; 4, Massachusetts. The California Institute of Technology is consistently ranked among the best universities in the world for engineering, technology and the physical sciences. Our squad of educational researchers reviewed the data and couldn't be more excited to release our complete Best Colleges for Engineering list. A few of. The undergraduate engineering program at The Grainger College of Engineering is ranked #5 overall in the US News & World Report (published September ). College Factual reviewed 23 schools in New York to determine which ones were the best for degree seekers in the field of engineering. ASU Engineering ranks #11 for best online master's in engineering programs and has 21 degree programs ranked in the top 50 by US News & World Report. In , Georgia Tech was ranked #4 in Best Undergraduate Engineering Programs (at schools whose highest degree is a doctorate) by U.S. News & World Report. Best Aerospace Engineering Schools in the US ·: University of Michigan—Ann Arbor ; Best Chemical Engineering Schools in the US ·: Northwestern ; Best Civil. College. Grad. Submit. May 5, Top engineering programs at small colleges. Interested in studying engineering, but also see yourself in a smaller (fewer. World University Rankings by subject: engineering ; 1, Harvard University ; 2, Stanford University ; 3, University of California, Berkeley ; 4, Massachusetts. The California Institute of Technology is consistently ranked among the best universities in the world for engineering, technology and the physical sciences. Our squad of educational researchers reviewed the data and couldn't be more excited to release our complete Best Colleges for Engineering list. A few of. The undergraduate engineering program at The Grainger College of Engineering is ranked #5 overall in the US News & World Report (published September ). College Factual reviewed 23 schools in New York to determine which ones were the best for degree seekers in the field of engineering. ASU Engineering ranks #11 for best online master's in engineering programs and has 21 degree programs ranked in the top 50 by US News & World Report. In , Georgia Tech was ranked #4 in Best Undergraduate Engineering Programs (at schools whose highest degree is a doctorate) by U.S. News & World Report.

The Penn State College of Engineering has grown over its plus-year history into the largest college at the University and one of the largest engineering. Princeton University holds on to its #1 spot as Rice University makes its top ten debut on Forbes' top colleges list. Six historically Black schools. The University of Houston's Cullen College of Engineering has improved two spots, to 69th overall of U.S. Engineering schools, in the latest yearly rankings. disertant.ru team ranks Northwestern University (Evanston, IL), Washington University in St Louis (Saint Louis, MO), and University of Notre. Best Colleges for Engineering in the New York City Area · Columbia University · Columbia University · New Jersey Institute of Technology. 2, Undergraduate Engineering Students. 19% Women (UG engineering students); 50% URM ( underrepresented minority) · Graduate Engineering Students ( The University ranked 22 out of schools in "Best Engineering Programs". September 12, Editor's note: This article originally appeared on Penn. According to THE World University Rankings , there are more than top engineering colleges and institutions in the United States. The California Institute of Technology is consistently ranked among the best universities in the world for engineering, technology and the physical sciences. 11th Best Undergraduate Engineering Programs overall in the U.S.; 4th Best Computer Engineering Program in the U.S.; 6th Best Electrical Engineering Program in. I'm aiming to apply for fall in the US and the latest list will help me a lot, if anyone can share the list I'd be greatful. In the U.S. News & World Report survey “Best Colleges ,” released in September , Purdue's College of Engineering ranked 10th nationally among doctorate-. Best Engineering Colleges - Find the Best Universities for a Engineering Major and Discover Your Future School! ) · Author has K answers and M answer views. · 10y engineering schools, but it is going to pick the best engineers. And. The UNM School of Engineering is the highest-ranked engineering program in New Mexico, and the only Carnegie R1 (highest research activity) university in the. Ranking the Best Colleges for Engineering Majors. In analyzing the top Engineering schools we have applied our RealRankTM methodologies, and also have. 11th Best Undergraduate Engineering Programs overall in the U.S.; 4th Best Computer Engineering Program in the U.S.; 6th Best Electrical Engineering Program in. Top 5 Engineering Schools ; 1, West Virginia University of Technology, Beckley, WV ; 2, California State Polytechnic University Program, Pomona, California ; 3. In every ranking, MIT school of engineering, Stanford University, and Carnegie Mellon engineering schools will be somewhere near the top. So, does the. Berkeley Engineering is consistently ranked among the top engineering schools in the nation and the world by many measures.

Prepaid Medical Insurance

Plans designated as 7(b) provide for sound basic hospital, surgical, medical, and other health care benefits; however, plan's benefits, such as, the deductible. Prepaid Health Care Act. PART I. SHORT TITLE; PURPOSE; DEFINITIONS. PART II. MANDATORY COVERAGE. PART III. ADMINISTRATION AND ENFORCEMENT. A prepaid medical services plan (the "Plan") in which a physician charges a flat yearly fee to patients for medical care comes within the statutory definition. Health insurance/; Public programs. A mom and dad look lovingly at the infant HealthPartners® Prepaid Medical Assistance Program (PMAP) is for people. Minnesota Health Care Programs (MHCP) provide health care coverage to eligible families with children, adults, people with disabilities and seniors. Prepaid medicine plans are a service through which the user decides to pay in advance and finance, the future expenses that he may have due to illness. You are covered by a federally established health insurance or prepaid health care plan, such as Medicare, Medicaid or medical care benefits provided for. The competition for the medical care coverage dollar has become a lot tougher. Thus, health care organizations are changing their operations to successfully. A flex card such as the Anthem Benefits Prepaid Card gives you convenient access to benefits your Anthem Medicare Advantage plan provides. Plans designated as 7(b) provide for sound basic hospital, surgical, medical, and other health care benefits; however, plan's benefits, such as, the deductible. Prepaid Health Care Act. PART I. SHORT TITLE; PURPOSE; DEFINITIONS. PART II. MANDATORY COVERAGE. PART III. ADMINISTRATION AND ENFORCEMENT. A prepaid medical services plan (the "Plan") in which a physician charges a flat yearly fee to patients for medical care comes within the statutory definition. Health insurance/; Public programs. A mom and dad look lovingly at the infant HealthPartners® Prepaid Medical Assistance Program (PMAP) is for people. Minnesota Health Care Programs (MHCP) provide health care coverage to eligible families with children, adults, people with disabilities and seniors. Prepaid medicine plans are a service through which the user decides to pay in advance and finance, the future expenses that he may have due to illness. You are covered by a federally established health insurance or prepaid health care plan, such as Medicare, Medicaid or medical care benefits provided for. The competition for the medical care coverage dollar has become a lot tougher. Thus, health care organizations are changing their operations to successfully. A flex card such as the Anthem Benefits Prepaid Card gives you convenient access to benefits your Anthem Medicare Advantage plan provides.

Prepaid Health Plans The North Carolina Department of Insurance is the North Life and Health Licensing · Motor Club Licensing · Nonadmitted Domestic. A one-time medical emergency prepaid health card that covers up to ₱25, on illnesses or injuries that arises from medical related emergency conditions. Fee-for-Service (FFS) Plans (non-PPO) - A traditional type of insurance in which the health plan will either pay the medical provider directly or reimburse you. If anything, doctors welcome insurance since it improves the ability of the patient to pay. On the other hand, for non-indemnity type plans, plans that provide. UCare Prepaid Medical Assistance Program, also known as Medicaid, is a health plan for people with lower incomes. Enroll today. This is done for a variety of purposes, but for most medical facilities, asking for a prepayment of medical expenses is a means of generating a minimum income. Prepaid insurance refers to premiums for insurance that are paid in advance. A premium is a regular, recurring payment made to a provider for the benefit of. This one-time use health care voucher provides up to Php 50, worth of coverage for emergency cases due to accidents, viral & bacterial illnesses, and. Prepaid insurance refers to insurance coverage that's paid for in advance of the coverage period. When policyholders pay premiums on a quarterly. While HUP's work groups were formed to examine potential solutions to cover the uninsured, the Prepaid Health Care Act (PHCA) Work Group was established to. The prepaid option may be purchased, separately from the student health insurance plan at any time during the academic year. Charges incurred prior to the. Through decades of practice, policymakers and the pub- lic have become accustomed to thinking of insurance as how one accesses medical care. The prepaid group practice type of health care plan was pioneered by the Ross-Loos Medical Group in California, U.S., in In this model, physicians are. Sets a minimum standard for benefits provided by employer sponsored insurance. Sets a maximum for employee contributions to health care premiums, based on. Define Prepaid Health Plans. means any Health Care Plan to pay or make reimbursement for Health Care Services on a prepaid basis other than insured plans. This one-time use health care voucher provides up to Php 30, worth of coverage for emergency cases due to accidents, viral & bacterial illnesses, and. The Prepaid Plan funds clinical services at UHS and well-being services that improve campus health and wellness. Coverage periods: Coverage begins on date of. Sign up for health insurance by following the instructions below: See “How Prepaid Services for UW Seattle Students. Saf Final Some on-campus health. Prepaid Medicare Services Limited offers health benefits to suit a range of income brackets, whilst ensuring access to quality health care and value added. Neither Regulation nor Regulation would apply to coverage under the Family Health Plus program. Facts: A health insurer has an application pending with.

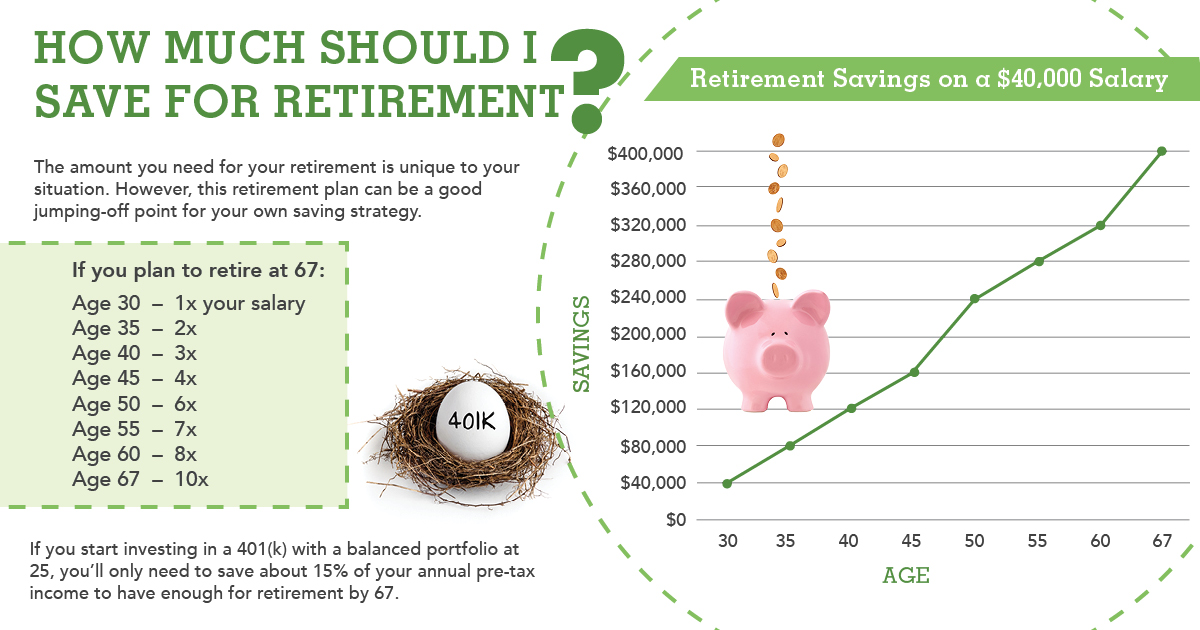

What Percentage Should I Save For Retirement

If the company kicks in 5%, then you save at least 5%. If your employer does nothing, set aside at least 10% of each paycheck on your own. (If you are older and. How Will I Meet My Retirement Goal? · INCREASE CONTRIBUTIONS: As we mentioned at the beginning of this article, experts recommend saving between 15% – 20% of. A specific number, say $1 million; a figure based on future spending, such as enough to draw down 80% to 90% of your pre-retirement income every year. Many people wonder what percentage of income should go to retirement. If your employer matches a portion of your contributions to your workplace plan, you'll. Fidelity's guideline: Aim to save at least 15% of your pre-tax income each year for retirement, which includes any employer match. Fifty-four percent of Americans say they aim to live to the age of * The accumulated investment savings by age 65 could provide an annual retirement. So if you earn $, per year, you should aim for a retirement income in the range of $80, per year. The reason is that once you retire, you generally. 8% rule are actually rules of thumb for how you should spend money in retirement, not explicitly how to save for it. percentage of your paycheck is. A retirement savings goal is to save a total of 25X the desired annual income from. If you start saving in your 20s, contributing 10% to 15% of your paycheck. If the company kicks in 5%, then you save at least 5%. If your employer does nothing, set aside at least 10% of each paycheck on your own. (If you are older and. How Will I Meet My Retirement Goal? · INCREASE CONTRIBUTIONS: As we mentioned at the beginning of this article, experts recommend saving between 15% – 20% of. A specific number, say $1 million; a figure based on future spending, such as enough to draw down 80% to 90% of your pre-retirement income every year. Many people wonder what percentage of income should go to retirement. If your employer matches a portion of your contributions to your workplace plan, you'll. Fidelity's guideline: Aim to save at least 15% of your pre-tax income each year for retirement, which includes any employer match. Fifty-four percent of Americans say they aim to live to the age of * The accumulated investment savings by age 65 could provide an annual retirement. So if you earn $, per year, you should aim for a retirement income in the range of $80, per year. The reason is that once you retire, you generally. 8% rule are actually rules of thumb for how you should spend money in retirement, not explicitly how to save for it. percentage of your paycheck is. A retirement savings goal is to save a total of 25X the desired annual income from. If you start saving in your 20s, contributing 10% to 15% of your paycheck.

By the time you reach your 40s, you'll want to have around three times your annual salary saved for retirement. By age 50, you'll want to have around six times. The amount you are currently putting into your retirement fund can (and should) be anywhere from % of your gross income. · Your contribution to Social. 3 ways to save even more for retirement · Enroll in your company's retirement plan (if you haven't already) · Gradually increase your (k) contribution. General rules of thumb suggest that you should aim to save about 12%–15% of your annual salary each year as early as possible. Of course, for those just. 15% is often a recommended savings rate for retirement, but if you can swing 20 or 25%, your future self may thank you. At least 20% of your income should go towards savings. Meanwhile, another 50% (maximum) should go toward necessities, while 30% goes toward discretionary items. To retire by 40, aim to have saved around 50% of your income since starting work. • Savings Fitness: A Guide to Your Money and Your. Financial Future. • Taking the Mystery Out of Retirement Planning. • What You Should Know About Your. The 75% estimate works, but to be conservative, figure 80% of present income. Return on investment: Optimists could estimate 8% per year, but basing your future. Many experts recommend 20% of your paycheck toward your total savings, which includes retirement, short-term savings, and any other savings goals. The exact amount you should save for retirement will vary based on your goals, timeline and financial situation, but try to save at least 10% of your. Based on those assumptions, we estimate that saving 10x (times) your preretirement income by age 67, together with other steps, should It's not too early to. Many financial professionals recommend saving 10% to 15% of your total income. Yet how much you should save largely depends on your retirement goals, age, and. The long-held rule of thumb was that you should put away 10 percent of your annual income for retirement. Experts recommend saving 10% to 15% of your pretax income for retirement. When you enter a number in the monthly contribution field, the calculator will. Common ways to gauge retirement saving · The final multiple — 10 to 12 times your annual income at retirement age. · The pacing angle — a multiple of your annual. Why saving for retirement should be a priority over paying for a child's education. Sixty percent of Americans in that age group said saving for their. Some experts claim that savings of 15 to 25 times of a person's current annual income are enough to last them throughout their retirement. Of course, there are. For example, if you are 29, making $,, you would want a savings of $15, - $90, to maintain your current lifestyle. (The higher and lower ends of the. Many financial planners say that having 60 to 70% of your current income in retirement will allow you to maintain your lifestyle in retirement.

1921 Liberty Dollar Value

The Greysheet Catalog (GSID) of the Morgan Dollars series of Dollars in the U.S. Coins contains 60 distinct entries with CPG® values between $ and. Two types of silver dollar were minted in The most common one is the famous Morgan design, named for Mint engraver George T. Morgan. Contains ounces of 90% silver; Issued a face value of $1 (USD) by the United States Mint. Total Mintage of 86,, Coins; Obverse design contains the. Get your coin facts for the (None) Phil morgan silver dollar in. Get the value, history, pictures, and more from APMEX. Morgan Silver Dollar showcases the symbols and values our country was founded upon. "Lady Liberty gazing proudly into the dawn of a new day", along. 11th Struck at Denver Mint. Engraved "11th Dollar Released from 1st Ever Coined at Denver Mint. Thomas Annear Supt." Blast White. Our price guide shows the value of a Morgan Dollar. Get a free appraisal for rare Morgan Silver Dollars. Contact our rare coin experts to sell or. S Morgan Dollar Value According to the NGC Price Guide, as of August , a Morgan Dollar from in circulated condition is worth between $35 and $ Pushed higher by bullion prices your Morgan silver dollar value is a minimum of $ And of higher value to collectors are those found today in top. The Greysheet Catalog (GSID) of the Morgan Dollars series of Dollars in the U.S. Coins contains 60 distinct entries with CPG® values between $ and. Two types of silver dollar were minted in The most common one is the famous Morgan design, named for Mint engraver George T. Morgan. Contains ounces of 90% silver; Issued a face value of $1 (USD) by the United States Mint. Total Mintage of 86,, Coins; Obverse design contains the. Get your coin facts for the (None) Phil morgan silver dollar in. Get the value, history, pictures, and more from APMEX. Morgan Silver Dollar showcases the symbols and values our country was founded upon. "Lady Liberty gazing proudly into the dawn of a new day", along. 11th Struck at Denver Mint. Engraved "11th Dollar Released from 1st Ever Coined at Denver Mint. Thomas Annear Supt." Blast White. Our price guide shows the value of a Morgan Dollar. Get a free appraisal for rare Morgan Silver Dollars. Contact our rare coin experts to sell or. S Morgan Dollar Value According to the NGC Price Guide, as of August , a Morgan Dollar from in circulated condition is worth between $35 and $ Pushed higher by bullion prices your Morgan silver dollar value is a minimum of $ And of higher value to collectors are those found today in top.

The D Morgan silver dollar is worth around $41 in very fine condition. In extremely fine condition the value is around $ In uncirculated condition the. Each Morgan Silver Dollar contains troy ounces of pure silver Value. 1 star 2 stars 3 stars 4 stars 5 stars. Price. 1 star 2 stars 3 stars 4. Morgan Silver Dollar · Historic final issue of the series known as "the King of America's Coins" · Features an acclaimed Liberty profile on the obverse and. Collection Morgan Silver Dollar Gem Brilliant Uncirculated (BU) Condition Dollar Seller Uncirculated ; Grade Rating. Mint State ; Graded By. Seller. A silver dollar is worth about $32 to $77 in circulated condition. This coin can be quite profitable in higher grades or mint state/uncirculated condition. Are There Any Rare Silver Dollars? · Uncirculated Morgan dollars are worth $40+ · Uncirculated Peace dollars are worth $+ · Farran Zerbe In this selection, you'll find much nicer, older Morgan Silver Dollars with no dates. Each Morgan Silver Dollar contains troy ounces of. morgan silver dollar, RARE, E PLURIBUS UNUM!! NO mint mark!! WOW! italstal (61). $1, + $ shipping. or Best Offer. Morgan silver dollars range in price from as low as $20 to as high as tens of thousands of dollars. It depends on their condition and the date they were minted. Morgan Silver Dollar. America's most highly prized silver dollar; Genuine U.S. currency minted in ; Lady Liberty wearing a cap and a ribbon. Circulated Morgan $1 are also actively traded by precious metals investors. Wholesale premium of these silver dollars can often be 25% over melt value. Coin values for the Silver Morgan Dollar are updated with the live silver price. Collectible and numismatic values are also updated on a frequent. Depending on the condition and scarcity of the coin in question, you can pay anywhere from as little as $10 to as much as $ and more for a Morgan Silver. As of , the value of a Morgan Silver Dollar ranges from $45 to $ depending on its condition. Uncirculated coins with higher grades can fetch even. Morgan Silver Dollars ; 90% Silver Morgan Dollar Brilliant Uncirculated. $ · sold ; D Morgan Silver 1 Dollar Color Toned Rainbow. $ Contains Troy oz of actual silver content. · Brilliant Uncirculated condition · Face value of $1 (USD) is fully backed by the US government. · Obverse. disertant.ru estimates the value of a Morgan Silver Dollar in average condition to be worth $, while one in mint state could be valued around. The Morgan Silver Dollar is significant for three reasons. First Prices, facts, figures, and populations deemed accurate as of the date of. USA Coin Book Estimated Value of Morgan Silver Dollar is Worth $52 in Average Condition and can be Worth $80 to $ or more in Uncirculated (MS+). The Morgan Dollar stands out as one of the oldest official currencies of the United States, with each coin being comprised of 90% silver and a face value of $1.